zhvorlangtidat.site

News

Is Chime A Bancorp Bank

Loans are issued by The Bancorp Bank, N.A. or Stride Bank, N.A.. Nationwide Multistate Licensing System (“NMLS”) Identification: Chime Capital, LLC – NMLS ID. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. My work involves dealing with payroll and setting up direct deposits, “chime” or “the Bancorp bank” both work just fine! Upvote 1. Downvote. Chime works with two regional banks, The Bancorp Bank and Stride Bank, to provide customers with a comprehensive, simple-to-use online bank account. They. Well-Regulated + FDIC-insured Chime is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A. Instead, Chime works with partner banks (The Bancorp Bank and Stride Bank) to provide a savings, a checking and a credit builder account. But you won't find. In Chime's case, the partner banks are Bancorp Bank, N.A. and Stride Bank, N.A., both FDIC members. This means your money is insured by the. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. Chime® is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Loans are issued by The Bancorp Bank, N.A. or Stride Bank, N.A.. Nationwide Multistate Licensing System (“NMLS”) Identification: Chime Capital, LLC – NMLS ID. Chime® is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. My work involves dealing with payroll and setting up direct deposits, “chime” or “the Bancorp bank” both work just fine! Upvote 1. Downvote. Chime works with two regional banks, The Bancorp Bank and Stride Bank, to provide customers with a comprehensive, simple-to-use online bank account. They. Well-Regulated + FDIC-insured Chime is a financial technology company, not a bank. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A. Instead, Chime works with partner banks (The Bancorp Bank and Stride Bank) to provide a savings, a checking and a credit builder account. But you won't find. In Chime's case, the partner banks are Bancorp Bank, N.A. and Stride Bank, N.A., both FDIC members. This means your money is insured by the. The Chime® Visa® Debit Card is issued by The Bancorp Bank, N.A. or Stride Bank pursuant to a license from Visa U.S.A. Inc. The secured Chime Credit Builder Visa. Chime® is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

Chime Financial, Inc. is a San Francisco–based financial technology company that partners with regional banks to provide certain fee-free mobile banking. Chime is a financial technology company that, with its bank partners, offers online checking and savings accounts as well as a credit-building secured credit. *Chime is a financial technology company, not a bank. Banking services provided by, and debit card issued by, The Bancorp Bank, N.A. or Stride Bank, N.A. My work involves dealing with payroll and setting up direct deposits, “chime” or “the Bancorp bank” both work just fine! Reply reply. At Chime, information security is a top priority. Deposits are FDIC insured up to $ through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. At Chime, information security is a top priority. Deposits are FDIC insured up to $ through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. Chime is a financial technology company that offers banking services through two banking partners: The Bancorp Bank, N.A. and Stride Bank, N.A., Members FDIC. The Bancorp Bank, N.A. Member FDIC. Equal Housing Lender. © The Bancorp, Inc. Terms of Use · Privacy Policy. A bank offering online banking services with no user no bank fees, and an option to receive direct deposit up to two days early. Chris Britt and Ryan King. On behalf of their banking partners, The Bancorp Bank and Stride Bank (Members FDIC), Chime offers members a mobile-first spending account, an optional. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. Contact Us ; Banking Services: (Monday-Friday 8am-8pm ET. Lost and stolen ATM/Debit Card afterhours support 24/7/) ; By Fax: ; By. Chime partners with The Bancorp Bank and Stride Bank to provide banking services to its customers. These partnerships allow Chime to offer a. Chime is an American financial technology company providing fee-free mobile banking services, owned by The Bancorp Bank or Central National Bank. Chime is a financial technology company that offers online banking services through its partners The Bancorp Bank and Stride Bank. Explore a checking account. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card and the Chime Credit Builder Visa® Credit. Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa. Chime partners with The Bancorp Bank to offer its users FDIC-insured accounts. This partnership enhances the security and reliability of Chime's banking. The Bancorp Bank, N.A. · Find an ATM | Contact Us | Help. Up to ten words are allowed. Banking services provided by The Bancorp Bank, N.A. Member FDIC. FDIC. Chime features hassle-free online banking solutions. Banking services are provided by The Bancorp Bank, N.A. or Stride Bank, N.A.

Home Depot Pro Rewards App

Save time with The Home Depot app. Shop over one million products and find the info you need most. The Pro Referral mobile app, powered by the Home Depot, helps you grow your business by connecting you with Home Depot customers in your area who need your. Members can download the app to easily access and manage their benefits, access savings with Virtual ID at checkout, redeem offers and track spending toward. In the App. Use the App to Scan Barcodes In Store to Find Preferred Pricing Eligible Items · Online. Sign In to zhvorlangtidat.site and Look for the Preferred Pricing. OMNIA Partners can receive up to a 5% annual rebate on all of your purchases as a Pro Xtra member with the agreement code “USC”. Discover new saving. Pro Xtra is a rewards program for contractors and other professionals who do business with The Home Depot. Customers can enroll online, in-app. Pro Xtra Perks is a benefit of the Program which enables Members to earn rewards (“Perks”) on up to $1,, of Qualifying Purchases in any Program Period . Home Depot Pro Xtra is the reward program made just for pros. I learned all about the special discounts, rewards and perks and share them with you here! Save time with The Home Depot app. Shop over one million products and find the info you need most. SNAP A PICTURE, FIND WHAT YOU NEED. Save time with The Home Depot app. Shop over one million products and find the info you need most. The Pro Referral mobile app, powered by the Home Depot, helps you grow your business by connecting you with Home Depot customers in your area who need your. Members can download the app to easily access and manage their benefits, access savings with Virtual ID at checkout, redeem offers and track spending toward. In the App. Use the App to Scan Barcodes In Store to Find Preferred Pricing Eligible Items · Online. Sign In to zhvorlangtidat.site and Look for the Preferred Pricing. OMNIA Partners can receive up to a 5% annual rebate on all of your purchases as a Pro Xtra member with the agreement code “USC”. Discover new saving. Pro Xtra is a rewards program for contractors and other professionals who do business with The Home Depot. Customers can enroll online, in-app. Pro Xtra Perks is a benefit of the Program which enables Members to earn rewards (“Perks”) on up to $1,, of Qualifying Purchases in any Program Period . Home Depot Pro Xtra is the reward program made just for pros. I learned all about the special discounts, rewards and perks and share them with you here! Save time with The Home Depot app. Shop over one million products and find the info you need most. SNAP A PICTURE, FIND WHAT YOU NEED.

Paint Rewards (up to 20% back). Local Pro. Purchase History. EXTRA 1% back in Quarterly Rewards. Day In-store Returns. The Home Depot's loyalty program for. Earn up to 4% back in Quarterly Rewards on all your qualifying purchases and link your Home Depot Credit Card for an extra 1% back. Plus, earn up to 20% back. For questions related to the Fuel Rewards® program, please contact Fuel Rewards® Member Services at and a Member Services Representative will be. For questions related to the Fuel Rewards® program, please contact Fuel Rewards® Member Services at and a Member Services Representative will be. Download our app and join the Pro Xtra Loyalty Program. Track and earn Pro Xtra benefits on the go with our app. Complete the “My Account Registration”. You now have 2 accounts and are eligible for all the rewards, benefits, and discounts on paint, bulk supplies, tax. 98K subscribers in the HomeDepot community. Hangout for Home Depot associates. No affiliation with The Home Depot Inc. This is not a. Access Benefits from Anywhere. Download The Home Depot Pro app to scan your Pro Xtra ID in stores and save more. Learn How. One of the ways they wanted to achieve this was through The Home Depot rewards program, Pro Xtra. Home Depot App. No alt text provided. With the Paint Rewards program, Pro Xtra members can save up to 20% on all their paints, stains and primer purchases. The Home Depot Pro Specialty Trades app lets you purchase items from your saved favorites list or customized product offering, as well as create, manage and. Hi, I got 3 reward perks currently for my expensive purchase at Home Depot. The first tier through 3rd tier. So a $25, $50 and $50 total. Save and earn rewards with The Home Depot ® and the Pro Xtra Credit Card · Save Up to $ Today · Earn Perks 4X Faster · Flexible Monthly Payments. Rewards Hub screen. Perk History. Download Our App. How doers get more done™. Need Help? Please call us at: HOME-DEPOT(). Customer. The Home Depot Pro provides exclusive savings, business tools, up to 20% off paints, purchase tracking, dedicated sales support, free in-store pick up, and. Pro Xtra is The Home Depot's free loyalty program built just for Pros – providing members with exclusive benefits that help them take their business to the. The updated program now includes benefits to recognize and reward its professional customers. Home-improvement retailer Home Depot launched an expanded. NARI Members enrolled in The Home Depot Pro Xtra Rebate program earn an average of $1, per rebate. · It's a program that covers the cost of your NARI. Pro Xtra benefits include: Perks. tracking. Purchase Tracking. exclusive-offers. Exclusive Offers. Volume Pricing Program. paint-rewards. Pro Xtra Paint Rewards. I'm glad they finally have a rewards system but wtf Spending $12k and they want to give me $60 store credit is kinda ridiculous. FYI: joint.

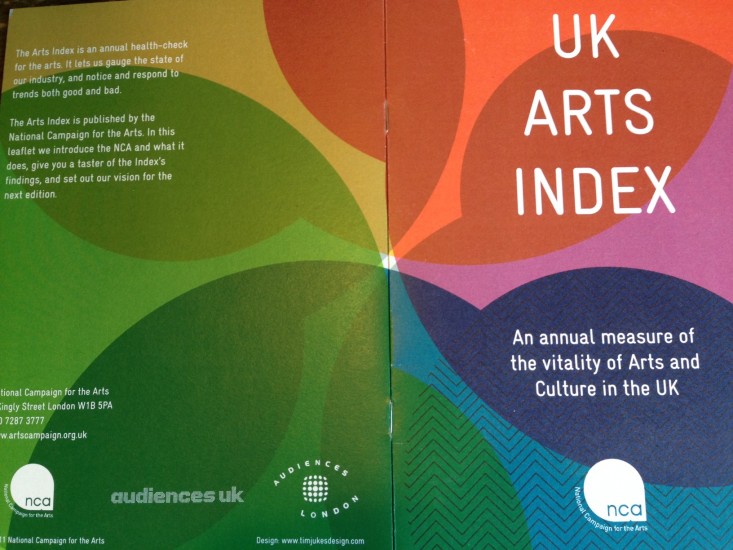

Art Index Fund

Art funds are generally privately offered investment funds dedicated to the generation of returns through the acquisition and disposition of works of art. Index · Arts + Social Impact Explorer · Profile of Art Prepare for National Arts in Education Week with Americans for the Arts and Arts Action Fund! Buy shares in contemporary fine art with Yieldstreet's brand-new art equity fund. Invest in s of artworks and grow your capital today! The Vanguard Index mutual fund In the long run this boring approach can give you more time for more interesting activities such as music, art, literature. The investment strategy of Scarabaeus Master Fund Class – QI ART 3x Index Fund is based on quantitative methodology and the volatility of movements. The Bitwise Blue-Chip NFT Index Fund is a simple and secure way to gain diversified exposure to an entirely new frontier in digital art and culture. Art funds are probably the closest things to an art ETF. Currently, there are two major art funds: Yieldstreet and Masterworks. Their International shares (Index) option now has total global exposure all in a single option. This includes exposure to international and emerging markets. Discover how art market indexes can help collectors and investors understand the state of the art market and make informed decisions about what they own. Art funds are generally privately offered investment funds dedicated to the generation of returns through the acquisition and disposition of works of art. Index · Arts + Social Impact Explorer · Profile of Art Prepare for National Arts in Education Week with Americans for the Arts and Arts Action Fund! Buy shares in contemporary fine art with Yieldstreet's brand-new art equity fund. Invest in s of artworks and grow your capital today! The Vanguard Index mutual fund In the long run this boring approach can give you more time for more interesting activities such as music, art, literature. The investment strategy of Scarabaeus Master Fund Class – QI ART 3x Index Fund is based on quantitative methodology and the volatility of movements. The Bitwise Blue-Chip NFT Index Fund is a simple and secure way to gain diversified exposure to an entirely new frontier in digital art and culture. Art funds are probably the closest things to an art ETF. Currently, there are two major art funds: Yieldstreet and Masterworks. Their International shares (Index) option now has total global exposure all in a single option. This includes exposure to international and emerging markets. Discover how art market indexes can help collectors and investors understand the state of the art market and make informed decisions about what they own.

While there are indexes that track the art market, notably the MeiMoses An index fund, for example, would have an R2 of Real Return. The return. Established in , Art Index offers independent art research, sales, and rental services. We specialize in investment-quality art from emerging stars and. About the Art Program. The DR Fund's Arts program supports arts and culture organizations that are using the arts to amplify social justice movements and/or. Most failed to match the performance of even a simple index fund portfolio, not even coming close to Yale's oversized returns. The Knight Frank Luxury. What are art investment funds? · Traditionally, art investment funds are privately managed art portfolios where a team of experts buy, store and sell paintings. The ART Global Macro (UCITS) fund invests quantitatively and Individuals cannot invest in the index itself, and actual rates of return. ART International Shares Index Unhedged Sup. Learn more about this managed fund including fund information, strategy, asset allocation & performance. Explore the Art Equity Fund II offering. According to the Artprice Index, blue-chip art has outperformed the S&P by over % from –*. The rich are not only getting richer but also growing in numbers, and fascinated by art. The Picasso Artprice index has grown % in the last 20 years in the. stocks or timing the market. In response to this groundbreaking research, a group of young money managers collaborated on developing the first index fund. I. ARTSGAIN is an equity fund management company open to qualified investors to jointly invest in art, including artworks, antiques, and collectibles. An art index tracks the sales and performance of various popular art pieces, similar to how an index fund tracks the performance of a particular stock index. art a part of their diversified investment portfolio investing in something like a market-tracking index fund. But like most. Collectibles are an alternative investment, which means they're not stocks, bonds, mutual funds, exchange-traded funds (ETFs), or cash. The Art Fund Association is the professional trade association for the art fund industry, providing a unified voice for a worldwide membership of art fund. Art investment funds are privately managed art portfolios. They're structured like other types of investment funds, like a mutual fund or a hedge fund. You. Investors should allocate % in art. Source: Mei Moses® Archives. Over a fifty year period, the art index has outperformed the S&P , while stocks have. The Art of Investing: Lessons from History's Greatest Traders. An award John Bogle, Index Mutual Fund Pioneer. John Bogle, Index Mutual Fund. The Sotheby's Mei Moses Indices are the preeminent measure of the state of the art market. Leveraging over repeat auction sales for the same object. I want exposure to fine art but can't afford the million dollar paintings yet. Does anyone invest in fine art-exposed ETFs (SPHB, XLY, MVPS)? Curious your.

Whats Better Roth Ira Or Traditional Ira

With a Roth IRA, you make contributions with after-tax dollars and you're not eligible for any immediate tax benefits or deductions. With a traditional IRA, you. Roth IRAs offer tax-free earnings, but contributions are not deductible. All fields are required. Current Traditional IRA amount. While traditional IRAs may provide immediate tax breaks because they're deductible and funded with pre-tax money, Roth IRA benefits happen on the back end, as. With a Roth IRA, you can leave the money in for as long as you want, letting it grow and grow as you get older and older. With a traditional IRA, by contrast. Which is better, a Traditional IRA or a Roth IRA? Traditional IRAs offer tax-deferred earnings and tax-deductible contributions. Roth IRAs offer tax-free. In almost all cases (assuming your Modified Adjusted Gross Income allows it), you should prefer to contribute annually to a Roth IRA rather than to a. With a traditional IRA, there is no income limit to contribute. Your contribution may reduce your taxable income and, in turn, your federal income taxes. A traditional IRA allows you to direct pre-tax income toward investments that can grow tax-deferred until your retirement. For me personally, I stopped contributing to a traditional IRA once I could only make non-deductible contributions- IMHO, it's better to do a. With a Roth IRA, you make contributions with after-tax dollars and you're not eligible for any immediate tax benefits or deductions. With a traditional IRA, you. Roth IRAs offer tax-free earnings, but contributions are not deductible. All fields are required. Current Traditional IRA amount. While traditional IRAs may provide immediate tax breaks because they're deductible and funded with pre-tax money, Roth IRA benefits happen on the back end, as. With a Roth IRA, you can leave the money in for as long as you want, letting it grow and grow as you get older and older. With a traditional IRA, by contrast. Which is better, a Traditional IRA or a Roth IRA? Traditional IRAs offer tax-deferred earnings and tax-deductible contributions. Roth IRAs offer tax-free. In almost all cases (assuming your Modified Adjusted Gross Income allows it), you should prefer to contribute annually to a Roth IRA rather than to a. With a traditional IRA, there is no income limit to contribute. Your contribution may reduce your taxable income and, in turn, your federal income taxes. A traditional IRA allows you to direct pre-tax income toward investments that can grow tax-deferred until your retirement. For me personally, I stopped contributing to a traditional IRA once I could only make non-deductible contributions- IMHO, it's better to do a.

A Roth IRA is a special type of individual retirement account that is generally not taxed, provided certain conditions are met. With a traditional IRA, contributions can be made on an after-tax basis, or a pre-tax (tax-deductible) basis if certain requirements are met. Any earnings in. Whether to open a Traditional or a Roth IRA is an important decision with different tax consequences. In short, contributions to a Traditional IRA may be tax. Use our calculator tool to find out which is right for you: a Traditional IRA or a Roth IRA. Generally, you're better off in a traditional if you expect to be in a lower tax bracket when you retire. By deducting your contributions now, you lower your. Traditional IRAs and Roth IRAs mainly differ in the timing of their tax benefits. Traditional IRAs provide a tax benefit in the present, while Roth IRAs. Pros of Traditional and Roth IRAs · Tax-free growth: Once money is in a traditional IRA, you won't pay taxes on dividends or capital gains until you withdraw the. Because if you don't pay taxes on this growth while it's in the IRA, your money may compound faster than it would if it were taxed immediately. In addition: A. While contributions to a traditional IRA are tax deductible subject to the income limits discussed above, contributions to a Roth IRA are funded with after-tax. What is the deadline to make contributions? Your tax return filing deadline (not including extensions). For example, you can make IRA contributions. A Roth can take more income out of your hands in the short term because you're forced to contribute in after-tax dollars. With a traditional IRA or (k), by. On the other hand, if you meet the income requirements for a Roth IRA and expect to be in a higher tax bracket later in life, paying taxes on your contributions. A Roth can take more income out of your hands in the short term because you're forced to contribute in after-tax dollars. With a traditional IRA or (k), by. A traditional IRA gives you a tax break when you deposit the money, then taxes you when you withdraw during retirement. · A Roth IRA gives no tax. Key differences between traditional and Roth IRAs: ; Potential earnings. Grow tax-deferred until withdrawal, Grow tax-free ; Tax deductible. Yes, if you meet. There are no penalties on withdrawals of Roth IRA contributions. But there's a 10% federal penalty tax on withdrawals of earnings. Exceptions to the penalty tax. On the flip side, it is more tax advantageous for people nearing retirement or those who are in higher tax brackets to contribute to a Traditional IRA. A traditional IRA is usually a good choice if you expect to be in a lower tax bracket in retirement because you'll pay fewer taxes when you withdraw the money. If that is the case, would you be better off contributing to a Traditional IRA now? What is your current tax rate? Are you just starting out your career and. When deciding between a traditional IRA or Roth IRA, consider your income and whether you prefer to pay taxes now or when you retire.

Low Balance Transfer Fee Cards

The Choice Rewards World Mastercard® from First Tech Federal Credit Union is a well-rounded card that has no annual fee, no foreign transaction fees, and a. Rates as low as % APR • Fixed Rate • No Balance Transfer Fees. You have many choices when selecting a contactless credit card. Make the switch today! Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Citi Simplicity® Card: Best feature: 0% introductory APR promotion. The best balance transfer fee is 0%, but if you can't find a card with that low of a fee or don't qualify for it, 3% is a reasonable transfer fee. Can Balance. How much could I save with no balance transfer fee and a low intro APR? · You could save $1, when you transfer a balance to a Navy Federal Credit Card. BMO Platinum Credit Card · 0% introductory APR on purchases for 15 months from date of account opening. · 0% introductory APR on balance transfers for 15 months. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance. %, % or % variable APR thereafter. Balance transfers made within days qualify for the intro rate and fee. Important Credit Terms · Apply now. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. The Choice Rewards World Mastercard® from First Tech Federal Credit Union is a well-rounded card that has no annual fee, no foreign transaction fees, and a. Rates as low as % APR • Fixed Rate • No Balance Transfer Fees. You have many choices when selecting a contactless credit card. Make the switch today! Citi Double Cash® Card: Best feature: month 0% introductory rate on balance transfers. Citi Simplicity® Card: Best feature: 0% introductory APR promotion. The best balance transfer fee is 0%, but if you can't find a card with that low of a fee or don't qualify for it, 3% is a reasonable transfer fee. Can Balance. How much could I save with no balance transfer fee and a low intro APR? · You could save $1, when you transfer a balance to a Navy Federal Credit Card. BMO Platinum Credit Card · 0% introductory APR on purchases for 15 months from date of account opening. · 0% introductory APR on balance transfers for 15 months. 3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance. %, % or % variable APR thereafter. Balance transfers made within days qualify for the intro rate and fee. Important Credit Terms · Apply now. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies.

One of the main reasons people choose is balance transfer credit cards is to capitalize on low or zero percent introductory APRs. This enables them to transfer. Many offers include a low or 0% introductory interest rate for balance transfers, which reduces or eliminates monthly interest charges on your balance transfer. You could clear the balance faster as you're not paying interest. You may pay less overall if the balance transfer fee is lower than the interest on your. With an APR as low as % and no annual or balance transfer fees, our low rate credit card is great for large purchases you want to pay off over time. The best credit card with no balance transfer fee is the Navy Federal Credit Union Platinum Credit Card because it offers an introductory APR of % for Move high-interest balances to your lower-rate Mountain America credit card or home equity line of credit. Cards like Citizens Clear Value® Mastercard® could be a top consideration if you want to transfer a balance. For instance, it offers an month 0% APR, which. After the intro period, a variable APR of Min. of (+) and %–Min. of (+) and %. Balance transfer fee applies, see pricing. Swing Into Savings With a CRCU Mastercard®! · Consolidate & simplify your finances · Pay down balances at a lower interest rate · NO balance transfer fee · NO. Low Balance Transfer Rate*** · No Annual Fees · No Balance Transfer Fees · No Cash Advance Fees · No Penalty Interest Rate · 1% cash back on all purchases · Easy and. Balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater. Low intro APRon purchases for 12 months. 0% Intro APR for I've searched for such as well, and the best I can find is Wells Fargo Reflect Card which has 0% APR for 21 months and 5% transfer fee, which is. 0% intro APR for 15 months; % - % variable APR after that; Balance transfer fee applies. See pricing and terms for details. Best 0% balance transfer cards ; Santander. - 26mths 0%. - 3% fee (min £5). - % rep APR · Apply* ; Virgin Money. - 20mths 0%. - 2% fee. - % rep APR. Check. There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be. BECU offers a low-rate and a Cash Back credit card that offers % cash back on every purchase. BECU also offers affinity card designs. With no annual fee and no PSECU balance transfer fee, the savings stay with you! Plus, you can transfer balances to the Classic Card as many times as you'd. With no balance transfer fee on our Summit Visa Card, the savings go right into your pocket. Choose a card to transfer your balance to: Gold. Take note that most balance transfer cards charge a balance transfer fee However, there are situations where card issuers may give you a lower balance. You might also lower your overall monthly payments and turn multiple bills into one easy payment. Balance transfer fees may apply. A balance transfer can give.

What Is The Lowest Priced Stock

Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. 7 cheapest stock photo subscriptions [NEW Offers] · #1: zhvorlangtidat.site – Club Unlimited: The Most Flexible & Cheapest Stock Photo Subscription · #2. Penny stocks are public companies that have a current share price of $ or less. These companies are listed on major stock exchanges and have market. Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low Fidelity® Low-Priced Stock Fund uses an opportunistic approach in seeking undervalued stocks. It focuses mostly on small- and mid-cap companies, including. A list of low priced stocks with highest volume traded on NYSE (New York Stock Exchange), USA. Fidelity® Low-Priced Stock Fund ; NAV Change. (%) ; YTD Returns. +% ; Morningstar ; Performance ; Average Annual Returns. AS OF 07/31/ low price shares ; Bank of India, , , ; Metroglobal, , , Best Penny Stocks Under $ Right Now · #1 - Lucid Diagnostics · #2 - Unicycive Therapeutics · #3 - Aptose Biosciences · #4 - Dragonfly Energy · #5 - Beyond Air · #. Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. 7 cheapest stock photo subscriptions [NEW Offers] · #1: zhvorlangtidat.site – Club Unlimited: The Most Flexible & Cheapest Stock Photo Subscription · #2. Penny stocks are public companies that have a current share price of $ or less. These companies are listed on major stock exchanges and have market. Stock Quote: NASDAQ: AAPL · Day's Open · Closing Price · VolumeM · Intraday High · Intraday Low Fidelity® Low-Priced Stock Fund uses an opportunistic approach in seeking undervalued stocks. It focuses mostly on small- and mid-cap companies, including. A list of low priced stocks with highest volume traded on NYSE (New York Stock Exchange), USA. Fidelity® Low-Priced Stock Fund ; NAV Change. (%) ; YTD Returns. +% ; Morningstar ; Performance ; Average Annual Returns. AS OF 07/31/ low price shares ; Bank of India, , , ; Metroglobal, , , Best Penny Stocks Under $ Right Now · #1 - Lucid Diagnostics · #2 - Unicycive Therapeutics · #3 - Aptose Biosciences · #4 - Dragonfly Energy · #5 - Beyond Air · #.

Most penny stocks or micro-cap companies are the product of a reverse merger. Old dormant public companies, generally without a business, without any assets. The conventional wisdom, in general, is that a stock can only go to zero, which turns out to be relatively good news for someone who's holding shares of that. Stock Quote: NASDAQ: COST. Day's Open. $ Closing Price. $ Intraday Low. $ Intraday High. $ Volume. 1,, Investment Calculator. Low-float stocks tend to be relatively few in number. Those that are low-float have lower trading volume, less market liquidity, wider price spreads. Explore curated stock watchlists to track and discover assets in a variety of categories. Low, Closing, Volume. 08/19/24, $, $, $, $, 13,, 08/20/24, $, $, $, $, 13,, 08/21/24, $, $ NIFTY 50 Cheapest Stocks · 1. O N G C, , , , , , , , , , · 2. B P C L, , Penny stocks refer to shares in companies with a low price and low trading volume. Because these markets have low liquidity, there is also high volatility. This. Table shows 52 week high and low prices reached in today's trading session. Chg and % Chg - change and percentage change are calculated from the previous. Lowest Market Cap: $ billion (at a share price of $); Highest Market Cap: $ billion (at a share price of $); Dividend Percentage: %. Renolt. low-price stocks. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny. Penny stocks are stocks that trade at a very low price, typically below $5 per share. They are often issued by small or newly established companies with low. Standard Views found throughout the site include: Main View: Symbol, Name, Last Price, Change, Percent Change, High, Low, Volume, and Time of Last Trade. In India, penny stocks refer to shares of small public companies traded at very low prices, typically under Rs These stocks are known for their high. A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries. That's the official definition at least. In spirit, these low-priced stocks are volatile and sketchy. They sell hope like other companies sell products. Despite. Low-Priced Securities Disclosure. Definition: The term "penny stock,” or “low-priced security,” generally refers to low-priced shares issued by a company. Penny stocks are low-priced shares with small market capitalization. In India, these stocks are typically priced below ₹ Due to their illiquidity, limited. Penny stocks are low-priced shares with small market capitalization. In India, these stocks are typically priced below ₹ Due to their illiquidity, limited. Penny stocks are low-priced shares of small companies, typically traded at INR10 or below. Famous for their high volatility and potential for significant.

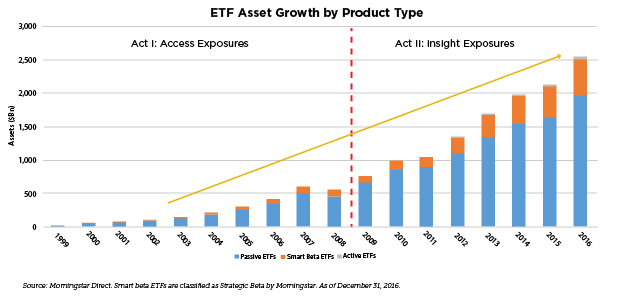

Growth Income Etf

Global X's Enhanced Growth ETFs provide an opportunity to potentially improve investment returns using light leverage. Explore Enhanced Growth ETFs. Large Dividend-focused, VYM, Vanguard High Dividend Yield ETF FTSE High Dividend Yield TR USD, Large Value, % ; Large Growth, SPYG, SPDR® Portfolio S&P Learn more about ETFs that aim to result in dividends and yields for traders who are seeking income or who may be risk-averse. Seeks to provide a high level of current income. The Fund's secondary objectives are to seek growth of income and capital. Active. Factsheet. U.S. Equity ETFs ; Focused Dynamic Growth ETF · FDG. Growth ; U.S. Quality Growth ETF · QGRO. Growth ; Sustainable Growth ETF · ESGY. Growth ; Low Volatility ETF · LVOL. A global multi-asset strategy designed with a neutral mix of approximately 82% equity factors, 15% systematic and actively managed fixed income ETFs and 3%. The Morningstar Income and Growth ETF Asset Allocation Portfolio seeks to provide investors with current income and capital appreciation. Strategy. The. ETF issuers who have ETFs with exposure to Growth are ranked on certain investment-related metrics, including estimated revenue, 3-month fund flows, 3-month. The fund has a total return goal, meaning that it seeks both capital appreciation and dividend income. The key risk for the fund is the volatility that comes. Global X's Enhanced Growth ETFs provide an opportunity to potentially improve investment returns using light leverage. Explore Enhanced Growth ETFs. Large Dividend-focused, VYM, Vanguard High Dividend Yield ETF FTSE High Dividend Yield TR USD, Large Value, % ; Large Growth, SPYG, SPDR® Portfolio S&P Learn more about ETFs that aim to result in dividends and yields for traders who are seeking income or who may be risk-averse. Seeks to provide a high level of current income. The Fund's secondary objectives are to seek growth of income and capital. Active. Factsheet. U.S. Equity ETFs ; Focused Dynamic Growth ETF · FDG. Growth ; U.S. Quality Growth ETF · QGRO. Growth ; Sustainable Growth ETF · ESGY. Growth ; Low Volatility ETF · LVOL. A global multi-asset strategy designed with a neutral mix of approximately 82% equity factors, 15% systematic and actively managed fixed income ETFs and 3%. The Morningstar Income and Growth ETF Asset Allocation Portfolio seeks to provide investors with current income and capital appreciation. Strategy. The. ETF issuers who have ETFs with exposure to Growth are ranked on certain investment-related metrics, including estimated revenue, 3-month fund flows, 3-month. The fund has a total return goal, meaning that it seeks both capital appreciation and dividend income. The key risk for the fund is the volatility that comes.

iShares Canadian Growth Index ETF · NAV as of Aug 30, CAD 52 WK: - · 1 Day NAV Change as of Aug 30, (%) · NAV Total Return as. Overview. Investment Objective. The Morningstar Income and Growth ETF Asset Allocation Portfolio seeks to provide investors with current income and capital. ETF List: ETFs ; IWF, iShares Russell Growth ETF, Blackrock ; IVW, iShares S&P Growth ETF, Blackrock ; SCHG, Schwab U.S. Large-Cap Growth ETF, Charles. Consider DGRW, a forward-looking ETF that seeks to help you capture dividend growth trends in industries and companies growing their dividends the fastest. The Global X S&P Covered Call & Growth ETF (XYLG) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the S&P Index. ETFs may yield investment results that, before expenses, generally correspond to the price and yield of a particular index. There is no assurance that the. Dynamic Active Balanced ETF Portfolio. 40% Fixed Income 60% Equity. Growth. Dynamic Active Growth ETF Portfolio. 20% Fixed Income 80% Equity. Key Benefits. A. The Simplify Enhanced Income ETF (HIGH) seeks to provide monthly income by selling short-dated put and/or call spreads on a variety of equity and fixed income. An actively managed transparent ETF, JGRO combines two time-tested, bottom-up fundamental approaches seeking underappreciated growth opportunities. exchange-traded funds (ETFs). Achieve a balance of long-term capital growth and income, with a significant bias towards capital growth, through the. Amplify ETFs deliver expanded investment opportunities for growth, capital preservation, and income-focused investors. Some good growth ETFs for consideration are the Vanguard Russell Growth ETF (VONG), the iShares Morningstar Mid-Cap Growth ETF (IMCG), the Vanguard Mid-Cap. Who should buy this fund? ; BMO NASDAQ Equity Index ETF. % ; BMO MSCI Emerging Markets Index ETF. % ; BMO Core Plus Bond Fund ETF Series. % ; iShares. At least once each year, the Fund will distribute all net taxable income to investors. These distributions will either be paid in cash or reinvested in the Fund. A growth and income fund is class of mutual fund or exchange-traded fund (ETF) that has a dual strategy of both capital appreciation (growth) and current. TMFS · Motley Fool Small-Cap Growth ETF · $ · % · % · Overview · Additional Documents · How to buy our ETFs. An actively managed portfolio of diverse, growth, and income generating securities can provide a solid, core position for investors' income needs. Systematic. Growth-focused portfolio that invests mostly in equity and to a lesser extent in fixed income ETFs with a growth oriented investment style. · Growth-focused. NYLI Growth ETF Allocation Fund seeks long-term growth of capital and, secondarily, current income.

Top Ten Lenders For Bad Credit

Get the money you need. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required. What are bad credit loans? Lenders often have minimum credit scores to qualify, which can make it harder for borrowers with poor credit to access most loans. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. You will usually need a credit score of around in order to qualify. There are some lenders that specialize in $ loans for applicants with poor credit as. Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. The lender's interest rates are competitive with low fixed rates. Loan details lenders that offer loans designed for borrowers with bad credit. That said. A bad credit loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score and/or poor credit history. Bad credit loans. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you. Get the money you need. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required. What are bad credit loans? Lenders often have minimum credit scores to qualify, which can make it harder for borrowers with poor credit to access most loans. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. You will usually need a credit score of around in order to qualify. There are some lenders that specialize in $ loans for applicants with poor credit as. Some lenders that cater to borrowers with poor credit have low loan maximums, but Upgrade allows borrowers to apply for as much as $50, And it requires a. The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. The lender's interest rates are competitive with low fixed rates. Loan details lenders that offer loans designed for borrowers with bad credit. That said. A bad credit loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score and/or poor credit history. Bad credit loans. Also, owing only small amounts of money—or having low usage numbers—will help maximize your score. Again, having bad credit won't necessarily disqualify you.

The best personal loans for bad credit include secured loans and loans from lenders that have low or no credit score requirements. Author. By Sarah Li-Cain. A bad credit loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score and/or poor credit history. Bad credit loans. Compare the best bad credit loans, vetted by experts to help borrowers with poor credit, find loans with the lowest cost and fees and flexible loan terms. Compare bad credit loan rates from top lenders for September ; Discover Personal Loans. Discover Personal Loans offers low APRs, repayment terms up to seven. And like all the non-credit union lenders on this list, expect to pay an APR close to % if you apply with poor credit. Pros. No set minimum credit score. These loans are easy to qualify for since no credit score is required. Best Egg offers the best personal loans for bad credit with a low minimum APR, starting. Down Payment. It is also very common for borrowers with poor credit to need the help of down payment assistance programs. Again, the ability to apply. While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. Types of business loans for poor credit offered by alternative lenders include: great credit, there are options to get a business loan with bad credit. If. Check your rate with no impact to your credit score Opens Dialog. young At least 10% of the applicants approved for these terms qualified for the. People with no credit are often discouraged by the idea of applying for a loan with a traditional bank or credit union. Bad credit personal loans often come in. We've made a list of mortgage lenders for poor credit, who deal with applicants who have a low credit score. A lot of the bad credit mortgage lenders in this. The best personal loans for bad credit include secured loans and loans from lenders that have low or no credit score requirements. Author. By Sarah Li-Cain. While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. There is plenty of good payday loan services out there. Just make sure you read all the details and pay it back on time. It's a loan. The best home loan option for you if you have bad credit depends on how low your score is. If your score is below , you probably should look into an FHA loan. The program allows for low down payments and has no minimum credit score requirement. However, if you have poor credit, expect to make a higher down payment. To. Even those with bad credit may qualify for startup funding. The lender will provide you with a full list of eligibility requirements for your loan. Be a for. Top 10 Best Bad Credit Loans in Los Angeles, CA - August - Yelp - Second Chance Financial, Fast Loans, Fix Your Credit Consulting, LoanCenter. the best bad credit loan services in the group. Credit scores are not 10 Best Credit Cards for Poor Credit.

How To File Back Taxes Online Free

Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. IRS Provides Free Online Tax Filing Service Join the 30 million Americans who already have saved money by using IRS Free File, the free way to electronically. Get our online tax forms and instructions to file your past due return, or order them by calling TAX-FORM () or for TTY/TDD. If you. Free to File. Easy to Use. Faster Refund. OH|TAX eServices. OH IRS e-file is a way to prepare and file your return electronically with the IRS and Ohio. It's not too late! File returns from previous years by selecting the tax year followed by your required software. KY File is designed to be the simple online version of a paper form. It allows you to: Select the Kentucky income tax forms and schedules that fit your filing. You can use H&R Block software back editions to get caught up on previous years' returns. It's best to double check your return against your IRS transcripts to. NOTE: The com Free File website must be accessed through the link above. Any other link used to access the com website may result in fees or charges. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax. IRS Provides Free Online Tax Filing Service Join the 30 million Americans who already have saved money by using IRS Free File, the free way to electronically. Get our online tax forms and instructions to file your past due return, or order them by calling TAX-FORM () or for TTY/TDD. If you. Free to File. Easy to Use. Faster Refund. OH|TAX eServices. OH IRS e-file is a way to prepare and file your return electronically with the IRS and Ohio. It's not too late! File returns from previous years by selecting the tax year followed by your required software. KY File is designed to be the simple online version of a paper form. It allows you to: Select the Kentucky income tax forms and schedules that fit your filing. You can use H&R Block software back editions to get caught up on previous years' returns. It's best to double check your return against your IRS transcripts to. NOTE: The com Free File website must be accessed through the link above. Any other link used to access the com website may result in fees or charges. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way.

Use TaxAct's easy, fast, and free online tax filing software to file basic federal taxes. It comes with step-by-step guidance and free support. These Free File products are affiliated with the Free File Alliance (FFA), which partners with the IRS and state revenue agencies to offer free electronic tax. Option 2: Free File Alliance (typically for Adjusted Gross Income $79, or less) Free File Alliance is partnership between the IRS/ADOR and tax software. Online - purchase software to prepare your taxes or, if eligible, use Free File · Paper Returns - File a paper return by mail or in person · Tax Professional -. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. Prepare and file your federal income tax return online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. You may be eligible for free e-file. Several tax preparation software providers offer free online electronic tax filing. For free online tax preparation. TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form and limited credits only, as detailed. Find a tax professional you trust to prepare and e-file your return. Nearly all tax preparers use e-file, and many are required to do so. To find an e-file. Do your taxes yourself online with My Free Taxes. You will need access to a computer, a valid email address, and all of your tax documents. Your information is. File your taxes for free with H&R Block Free Online. eFile taxes with our DIY free online tax filing service and receive the guaranteed max refund you deserve. Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved software for less or free of. These Free File products are affiliated with the Free File Alliance (FFA), which partners with the IRS and state revenue agencies to offer free electronic tax. Free File · Do you qualify to file for free? · Free File Options · Other Free Electronic Filing Options. E-File · For more information, visit our E-file Frequently Asked Questions. · Free Online Filing of Federal and State Income Tax Returns through the Free File. Online Taxes at zhvorlangtidat.site would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is $45, or. FreeTaxUSA. FreeTaxUSA will be offering free electronic preparation and filing services for both Federal and Montana tax returns to eligible Montana taxpayers. E-File your tax return directly to the IRS for free. Prepare federal and state income taxes online. tax preparation software. NYC Free Tax Prep for Individuals and Families · Visit zhvorlangtidat.site · Scroll down to "File Myself" and begin the process. myPATH: A secure, state-only electronic filing system – offered exclusively through the Department of Revenue – which allows most taxpayers to prepare and.

Scrum Certification Price

Apply for the exam by paying USD or by using the exam voucher provided by the SCRUMstudy™ A.T.P. You need to submit relevant documents (if required). Access. The price of acquiring a Scrum Master certification diverge depending on which learning option you opt, the provider you choose and the location. After up to two attempts within 90 days, there's a $25 charge for each additional attempt. The questions on the CSM test are based on the CSM Content Outline. Checkout here to learn and understand SAFe® 5 Scrum Master (SSM) Certification- Cost. In this guide, you will explore much about SAFe® 5 Scrum Master (SSM). Currently, the fee for the BVOP™ Scrum exam is $ However, when you register for an account, you will receive a discount code, and once you use it, the price. The cost of the 2-day Certified Scrum Master or CSM course is between $ and $ in US and between INR 18, to INR in India. The. If you are just finishing college and want to get a certification, I would recommend the PSM1, which will cost $ You can study the materials. The Agile Scrum Master exam fee is USD, although this can vary based on factors such as location, currency fluctuations, and additional services provided by. Anyone who is interested in becoming a Scrum Master, Cost of Exam USD , Maintaining certification Take SMC® Recertification exam every 3 years or earn any. Apply for the exam by paying USD or by using the exam voucher provided by the SCRUMstudy™ A.T.P. You need to submit relevant documents (if required). Access. The price of acquiring a Scrum Master certification diverge depending on which learning option you opt, the provider you choose and the location. After up to two attempts within 90 days, there's a $25 charge for each additional attempt. The questions on the CSM test are based on the CSM Content Outline. Checkout here to learn and understand SAFe® 5 Scrum Master (SSM) Certification- Cost. In this guide, you will explore much about SAFe® 5 Scrum Master (SSM). Currently, the fee for the BVOP™ Scrum exam is $ However, when you register for an account, you will receive a discount code, and once you use it, the price. The cost of the 2-day Certified Scrum Master or CSM course is between $ and $ in US and between INR 18, to INR in India. The. If you are just finishing college and want to get a certification, I would recommend the PSM1, which will cost $ You can study the materials. The Agile Scrum Master exam fee is USD, although this can vary based on factors such as location, currency fluctuations, and additional services provided by. Anyone who is interested in becoming a Scrum Master, Cost of Exam USD , Maintaining certification Take SMC® Recertification exam every 3 years or earn any.

Scrum Master is the best certification course to get enrolled in. The certification cost of Scrum Master course is Rs. 25k and is valid for 1 year. Certification Details · $ USD per attempt · Passing score: 85% · Time limit: 60 minutes · Number of Questions: 80 · Format: Multiple Choice, Multiple Answer, True. Rating: out of reviews questionsAll LevelsCurrent price: $ Practice high-quality Certified Scrum Master exam questions. UC Agile offers the most competitive course rates for Scrum Certification! The CSM and CSPO courses each cost $ Our course fees include: 2-days of live. Best Rated Certified Scrum Master Certification · Guaranteed to Run 20+ Live Cohorts in a month · Gain complimentary access to Agile and Scrum courses worth $ Certified ScrumMaster® (CSM) Training ; Get This Course $1, GOV $1, For Team Prices Call: ; ICAgile. Agile Testing Strategies and Practices. You can expect the SAFe Scrum Master (SSM) by Scaled Agile training and certification to cost from $ to $ Retake fee is $50; $ for SAFe Program. There are different types of certified Scrum masters. They hold different costs according to their value in the market. Certified Scrum Master costs to. $ USD Save $ USD. SMPC is a (registered) Trade Mark of CertiProf, LLC. All rights reserved. CertiProf offers the Scrum Master Professional. The cost of Scrum Master certification can vary widely depending on several factors, including the certification body, the quality of training, and the included. Certification Details · $ USD per attempt · Passing score: 85% · Time limit: 90 minutes · Number of Questions: 30 (partial credit provided on some questions). The Cost of the CSM exam ranges from Rs to , which includes 2 days of formal training, 16 PDU required to clear the exam and a membership with the. Your test and certification cost in total USD No other hidden costs or fees involved. In order to pass your certification examination and obtain your Scrum. To renew the certification, you must earn 7 PDUs in agile topics and pay the $ renewal fee. Active PMI members can renew at the reduced price of $ per. A-CSM® Certification Cost Summary: ; Cost Splits. Training Cost (Includes Certification) ; Online Training. Between $ To $ ; Certification Renewal Cost. The cost of PSM II test is $ USD per attempt. Test passwords do not expire and remain valid until used. See more details below. Protecting the integrity of. Find out the cost of CSM in India and worldwide. Learn about the different factors that can impact the cost and make an informed decision. Four non-consecutive remote training days, leading to the Scrum Alliance Certified Scrum Professional – ScrumMaster zhvorlangtidat.site: Please select dates. The professional scrum master certification exam cost is $ and for PSM 2 is $ The PSM price varies in different countries. The table below shows. There is no fee for these assessments and they can be used by anyone to prepare for the certification test, validate your basic knowledge, during job interviews.