zhvorlangtidat.site

Tools

Ho4 Policy Coverage

HO-4 policies provide personal property, loss of use, personal liability, and medical expense coverages. Renters can determine the amount of coverage they would. The HO4 insurance policy is most commonly referred to as renters insurance. Whether you rent a home, condo, townhome, or apartment, if you purchased. An HO-4 insurance policy is an insurance policy for renters that helps protect their belongings, personal liability, and additional living expenses. Home Renters Insurance is designed to cover tenants' personal properties from fire & theft. Get a free quote for a property today! Designed specifically for condo owners and tenants, these policies provide coverage for personal property, liability protection, and additional living expenses. Actual cash value coverage pays what the property was worth at the time damage or loss occurred, meaning it discounts the claim payout due to age or wear and. HO4 insurance is insurance for renters. This insurance policy covers personal property for 16 specific named perils. These policies are usually inexpensive. An HO-4 insurance policy protects your possessions in the event of covered perils. It also provides personal liability and loss of use coverage. Does an HO HO-4 insurance is designed for renters only, with coverage for loss of use (if the renter is unable to live in their rented house or apartment), personal. HO-4 policies provide personal property, loss of use, personal liability, and medical expense coverages. Renters can determine the amount of coverage they would. The HO4 insurance policy is most commonly referred to as renters insurance. Whether you rent a home, condo, townhome, or apartment, if you purchased. An HO-4 insurance policy is an insurance policy for renters that helps protect their belongings, personal liability, and additional living expenses. Home Renters Insurance is designed to cover tenants' personal properties from fire & theft. Get a free quote for a property today! Designed specifically for condo owners and tenants, these policies provide coverage for personal property, liability protection, and additional living expenses. Actual cash value coverage pays what the property was worth at the time damage or loss occurred, meaning it discounts the claim payout due to age or wear and. HO4 insurance is insurance for renters. This insurance policy covers personal property for 16 specific named perils. These policies are usually inexpensive. An HO-4 insurance policy protects your possessions in the event of covered perils. It also provides personal liability and loss of use coverage. Does an HO HO-4 insurance is designed for renters only, with coverage for loss of use (if the renter is unable to live in their rented house or apartment), personal.

HO-4 — Simply speaking, this policy type describes a renters insurance policy. Typically with these policies, your liability and your personal property are. An HO-4 tenant's form homeowners policy is insurance that covers a renter's personal property and liability for injuries incurred by guests on the property. HO-4 - Renters Form or Tenants Form. This policy type is specifically for renters since it covers only belongings and personal liability and not the building. An HO-4 policy, also known as a renters insurance policy, protects your personal belongings. An HO-4 renters' policy provides “named perils” coverage, which. The policy also covers liability coverage in case someone is hurt on the property you are renting. There is also coverage for any additional living expenses. Standard homeowner and tenant policies are package policies that typically include property, liability, theft, and medical payments coverage. HO-4 Coverage Worksheet | Tenant Contents Please refer to your Citizens policy, or contact your agent if you have questions about your Citizens coverage. HO4 insurance is an insurance policy for people renting a home, apartment, or condo. It usually includes personal property, liability, and loss of use coverage. In General, Who's It For? HO4 policies are available for rental properties zhvorlangtidat.site6 policies are going to be for a condo owner and it will cover your personal. Coverage E normally provides a defense and will pay damages, as the insurance company deems appropriate. There are some exceptions. The liability coverage will. HO-4 policies are commonly known as renters insurance and provide coverage for tenants who want insurance for their rented dwelling. The purpose of this kind of. Standard homeowner and tenant policies are package policies that typically include property, liability, theft, and medical payments coverage. HO-4 Renter's Insurance: Designed for tenants, the HO-4 policy provides coverage for personal belongings within a rented dwelling. It protects against. What it is: HO-4 is more commonly known as renter's insurance. As such, HO-4 policies are specifically designed for those who are renting or leasing an. HO-4 Renter's Insurance: Designed for tenants, the HO-4 policy provides coverage for personal belongings within a rented dwelling. It protects against. This coverage is additional insurance. No de- ductible applies to this coverage. 5. Property Removed. We insure covered property against direct loss from any. HO-4 insurance is the technical term for renters insurance. While your landlord likely insures the physical structure of the building you live in, an HO We make it insanely easy to explore carriers, compare rates and get the coverage you need. We're here to help you navigate all things auto insurance and save. Identity Theft or Identity Fraud. Expense Coverage. No. Yes, can purchase $25, Incidental Occupancy. Property – 30% of Coverage C. Yes, Liability can be. HO4 Policy – Contents Broad Coverage for Renters: This provides coverage for a renter's belongings, personal liability, and loss of use. HO5 Policy.

Best Low Fee Ira

Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Compare the best IRA CD rates ; Elements Financial. 12 Month Flex IRA Special. (19 Reviews). % ; Central Willamette Credit Union. 1 Year Flex IRA. (1. Answer a few simple questions and our Help You Decide tool will tell you which IRA may be best for your needs. No other charges or expenses and no market. Simplified investing with low fees. Portable IRA that belongs to you. CalSavers can help you on the path to retirement savings. Learn more about your. Our regular savings option features no fees, competitive interest rates and a low minimum balance. happy man in Fargo office – checking his Gate City Bank money. It doesn't have to be "managed". Open a Roth IRA at Fidelity or Vanguard and put % of your money into a Target Date Fund. Pick the fund with. There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. Types of IRAs: What is the best IRA for me? No matter your retirement Low or no fees. No account opening or maintenance fees and no minimums to. Fidelity is probably the most user-friendly option right now. They've caught up (if not passed) Vanguard around their selection of low expense. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Compare the best IRA CD rates ; Elements Financial. 12 Month Flex IRA Special. (19 Reviews). % ; Central Willamette Credit Union. 1 Year Flex IRA. (1. Answer a few simple questions and our Help You Decide tool will tell you which IRA may be best for your needs. No other charges or expenses and no market. Simplified investing with low fees. Portable IRA that belongs to you. CalSavers can help you on the path to retirement savings. Learn more about your. Our regular savings option features no fees, competitive interest rates and a low minimum balance. happy man in Fargo office – checking his Gate City Bank money. It doesn't have to be "managed". Open a Roth IRA at Fidelity or Vanguard and put % of your money into a Target Date Fund. Pick the fund with. There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. Types of IRAs: What is the best IRA for me? No matter your retirement Low or no fees. No account opening or maintenance fees and no minimums to. Fidelity is probably the most user-friendly option right now. They've caught up (if not passed) Vanguard around their selection of low expense.

E*TRADE - the best IRA brokerage in Low trading fees (free stock and ETF trading). User-friendly mobile trading platform. Great research tools. Pays. For easy investing at a low cost, open an IRA through Automated Investor from U.S. Bancorp Investments. This robo-advisor combines our expertise and. Self directed IRA investing made easier with lower fees and one-on-one help from experts. The best self directed IRA custodian for real estate investments. So much for low tax rates in retirement! Filling the Buckets with Partial IRA is available to fund a good portion of your retirement expenses. Merrill Edge's Roth IRA scored a spot on our list thanks to its zero-dollar account minimum and lack of account fees. It also scored highly on our customer. Why Wealthfront: With low fees and small minimums ($), this platform delivers quite a powerful punch without costing an arm and a leg. Plus, anyone can take. Let's go over the common fee structures of IRAs and some of the providers with the lowest IRA fees. Fortunately, the best discount brokers have. Roth IRA. Tax-free growth1. With a Fidelity Roth IRA, you get the flexibility Broker for ETFs, and Best Broker for Low Costs, among 25 companies. The. Roth IRA · Pay taxes now. · Receive tax-free withdrawals from qualified distributions. · May be a good option if you're in a lower tax bracket. · Minimum investment. Build yourself a small portfolio of low cost index funds. They're extremely cheap to own, and can give you great diversity and multiple. Best if you want: Charles Schwab offers a self-directed IRA with an easy-to-use, low-cost trading account from the broker that pioneered low-commission trades. Ability to work with a Financial Advisor who will develop a personalized investment strategy based on your goals. A simple, easy way to get a low cost. What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a: bank or other. No annual or custodial fees on your Bank of America IRA. Compare Best Overall Identity Safety in Banking, Javelin Strategy & Research. Enrolling in an Empower Premier IRA is a simple, straightforward, low-cost way to invest. Plus, it has great tax advantages, too. You can invest confidently. Compare IRAs. The two most common types of IRAs work differently. Learn more about which may be the best choice for your retirement strategy. Compare. Vanguard is known for its low-cost index funds and offers a variety of IRA account types, including traditional, Roth, and SEP IRAs. As far as financial. IRA savings accounts may work best for people who want to diversify their You can sign up for Digital Investor, our low-cost online investing tool. Best for: Building your IRA over time with unlimited deposits up to your annual contribution limits. Annual Percentage Yields (APYs) displayed are accurate as. No account fees or minimums to open Fidelity retail IRA accounts. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs), and.

Best Way To Earn Frequent Flyer Miles

This estimator should be used as a guide only. The estimates provided are generally based on published, scheduled service operated by Southwest Airlines®. As an Etihad Guest Member you will earn miles every time you fly with Etihad Airways. Live near a major hub and get a job where you travel frequently and/or very long distances. · Use a card that gives you personal points for. Each time you fly with Delta's 20+ trusted airline partners anywhere in the world, you earn miles. Many of the easiest and best offers are listed there, because they defy categorization. Check out the Dining programs, for example. And don't sign up for a. Credit card travel rewards are a simple, straightforward way to earn points and miles to cover expenses for your next trip. Really, what's easier than spending. 1> Frequent Flyer Programs: Joining an airline's frequent flyer program is the most direct way to earn miles. These programs often offer miles. 1. Choose an airline · 2. Use your credit card · 3. Shop online · 4. Earn on your accommodation · 5. Earn on your rental car · 6. Use your points on less popular. Choose the right credit card · Take advantage of bonus offers · Be flexible with travel dates · Compare airfare prices · Review reward transfer ratios. This estimator should be used as a guide only. The estimates provided are generally based on published, scheduled service operated by Southwest Airlines®. As an Etihad Guest Member you will earn miles every time you fly with Etihad Airways. Live near a major hub and get a job where you travel frequently and/or very long distances. · Use a card that gives you personal points for. Each time you fly with Delta's 20+ trusted airline partners anywhere in the world, you earn miles. Many of the easiest and best offers are listed there, because they defy categorization. Check out the Dining programs, for example. And don't sign up for a. Credit card travel rewards are a simple, straightforward way to earn points and miles to cover expenses for your next trip. Really, what's easier than spending. 1> Frequent Flyer Programs: Joining an airline's frequent flyer program is the most direct way to earn miles. These programs often offer miles. 1. Choose an airline · 2. Use your credit card · 3. Shop online · 4. Earn on your accommodation · 5. Earn on your rental car · 6. Use your points on less popular. Choose the right credit card · Take advantage of bonus offers · Be flexible with travel dates · Compare airfare prices · Review reward transfer ratios.

Credit card travel rewards are a simple, straightforward way to earn points and miles to cover expenses for your next trip. Really, what's easier than. You can earn frequent flyer points by accumulating 'miles' based on the distance flown, on the specific sectors travelled, on dollars spent on the flight or. Japan Airlines' membership program. Earn miles from flights, hotel stays You can log in zhvorlangtidat.site can book and check award flights, and check how many miles. 2. Always fly indirectly Indirect flights are usually cheaper and, because you get status points for every leg of your journey, you get your status more. There are many ways to earn miles with SkyMiles. You can earn miles on flights, special offers or with a credit card – so you're closer to rewards. After signing up for their frequent flyer program, you earn points based on how much you pay for the flight. If you have status with the airline, you can earn. Transfer your points to your frequent-flyer program*, and as a bonus, we'll add 5,** miles for every 60, points you transfer to frequent flyer miles. Earn miles to earn Loyalty Points · Fly with partner airlines · Earn on hotels · Earn on car rentals · Find answers and support · Have questions? · Join the. Notice we've left travel, the most widely known way to earn miles/points, for last. While traveling is a tried-and-true way to earn, it's not the most effective. Build your mileage balance with the MileagePlus X app. Earn miles on shopping, dining, and eGift Card purchases with our free and easy to use app. Download MPX. Airline miles are available through airlines and credit card issuers. To earn directly from an airline, you start by enrolling and participating in its loyalty. Earn miles to use on travel while earning Loyalty Points toward rewards and status. You'll earn when you fly, use an American Airlines AAdvantage® credit card. Getting an airline credit card can help you earn miles and free flights faster than a frequent flyer program alone, especially with large signup bonuses. The. Whenever you fly with one of our member airlines, provide your frequent flyer number when booking your flight or when checking in, and the miles or points will. 1. Choose an airline · 2. Use your credit card · 3. Shop online · 4. Earn on your accommodation · 5. Earn on your rental car · 6. Use your points on less popular. The amount you spend on your flight, the type of fare, your tier status, and the payment method you choose all determine how many points you can earn. This. Travel Miles are earned in several ways, making eligible purchases on zhvorlangtidat.site, using your FRONTIER Airlines World Mastercard®, earning miles with a. Our top picks for Redemptions. Now that you've earned your Velocity Points, discover the exciting possibilities on how to redeem your well-deserved Velocity. Whenever you fly with one of our member airlines, provide your frequent flyer number when booking your flight or when checking in, and the miles or points will. For any other ticket, you can get miles/points from the card used for the entire purchase. If you want United miles, paying with a United credit.

Appraising Rental Property

A rental appraisal details what level of rent an investment property might generate. This document includes valuable information, such as current market trends. The most widely-used and accepted in residential practice is the sales comparison approach. This approach bases its opinion of value on what similar properties. GRM is an Income Approach that applies to homes with long term tenants, not homes with many STRs. The gross rent multiplier (GRM) is applicable in residential. In the case of income producing properties - rental houses for example - the appraiser may use an additional way of valuing real estate. In this scenario, the. The income approach in real estate appraisal values a property based on its ability to generate income, typically used for commercial or investment properties. The appraisers at Houston Appraisal Company have the experience and expertise needed to provide such services for Residential or Commercial properties at. Real estate valuation is a process that determines the economic value of a real estate investment. · The capitalization rate is a key metric for valuing an. The most common reason for an appraisal is that the bank needs to know the value of the house before it's willing to lend money. The bank won't. The appraiser will estimate the property's potential income based on its rental history or market rents, and then subtract any operating expenses, like property. A rental appraisal details what level of rent an investment property might generate. This document includes valuable information, such as current market trends. The most widely-used and accepted in residential practice is the sales comparison approach. This approach bases its opinion of value on what similar properties. GRM is an Income Approach that applies to homes with long term tenants, not homes with many STRs. The gross rent multiplier (GRM) is applicable in residential. In the case of income producing properties - rental houses for example - the appraiser may use an additional way of valuing real estate. In this scenario, the. The income approach in real estate appraisal values a property based on its ability to generate income, typically used for commercial or investment properties. The appraisers at Houston Appraisal Company have the experience and expertise needed to provide such services for Residential or Commercial properties at. Real estate valuation is a process that determines the economic value of a real estate investment. · The capitalization rate is a key metric for valuing an. The most common reason for an appraisal is that the bank needs to know the value of the house before it's willing to lend money. The bank won't. The appraiser will estimate the property's potential income based on its rental history or market rents, and then subtract any operating expenses, like property.

A rental property appraisal is a way for you, the investor, to get an idea of your property's current rental market value. If you were to list your property in. A rental appraisal focuses on determining the fair rental price for a property in the current market. Real estate agents or property managers typically perform. Affordable multi-family residential rental housing has been created through a range of public funding programs, most of which impose restrictions that run. Following the inspection, an appraiser can use different approaches to determine the value of the property: paired sales analysis and, in the case of a rental. The 4 methods used to value rental property are the income/cap rate approach, gross rent multiplier, sales comparison approach, and the multimethod Stessa. So, what party is responsible for making sure the property is worth the purchase price? This is where the appraiser comes in. We provide an unbiased estimate of. It's important that appraisers, lenders, and underwriters become familiar with the nuances of valuing these properties. In this seminar, you will gain a basic. The appraiser may ask about the property's title, sales and rental history, and occupancy. He or she might ask if the property is under a pending purchase and. Real estate appraisal, property valuation or land valuation is the process of assessing the value of real property (usually market value). On a rental property - Tenant income will be a credit towards your income. Banks will allow 70% (they figure a 30% vacancy rate) of tenant inco. When including short term rental income on the appraisal, where do you get your data? It's a purchase transaction, the property is on AirBnB. The rental appraisal of a property is a process through which the estimated value of rent that can be obtained for said property in the real estate market, this. Yes, the tenant may have an appraisal done - the tenant does not need the landlord's "okay" prior to the matter to do so. In my experience, if you are using conventional financing, the appraisal will be based entirely (or almost entirely) upon the comparable sales in the area. The. It's important that appraisers, lenders, and underwriters become familiar with the nuances of valuing these properties. In this seminar, you will gain a basic. A third method of valuing a property is sometimes employed when an area has a measurable number of rental properties. In this case, the amount of revenue the. To accurately evaluate investment properties, our real estate appraisers possess in-depth knowledge of construction and replacement costs, as well as advanced. rental properties to the subject property. This analysis is intended to Rent Schedule: The appraiser must reconcile the applicable indicated monthly market. Determining the current rental rates for comparable properties, considering factors such as number of rooms, size, property condition, amenities, and any unique.

What Is An Fha Loan Mean

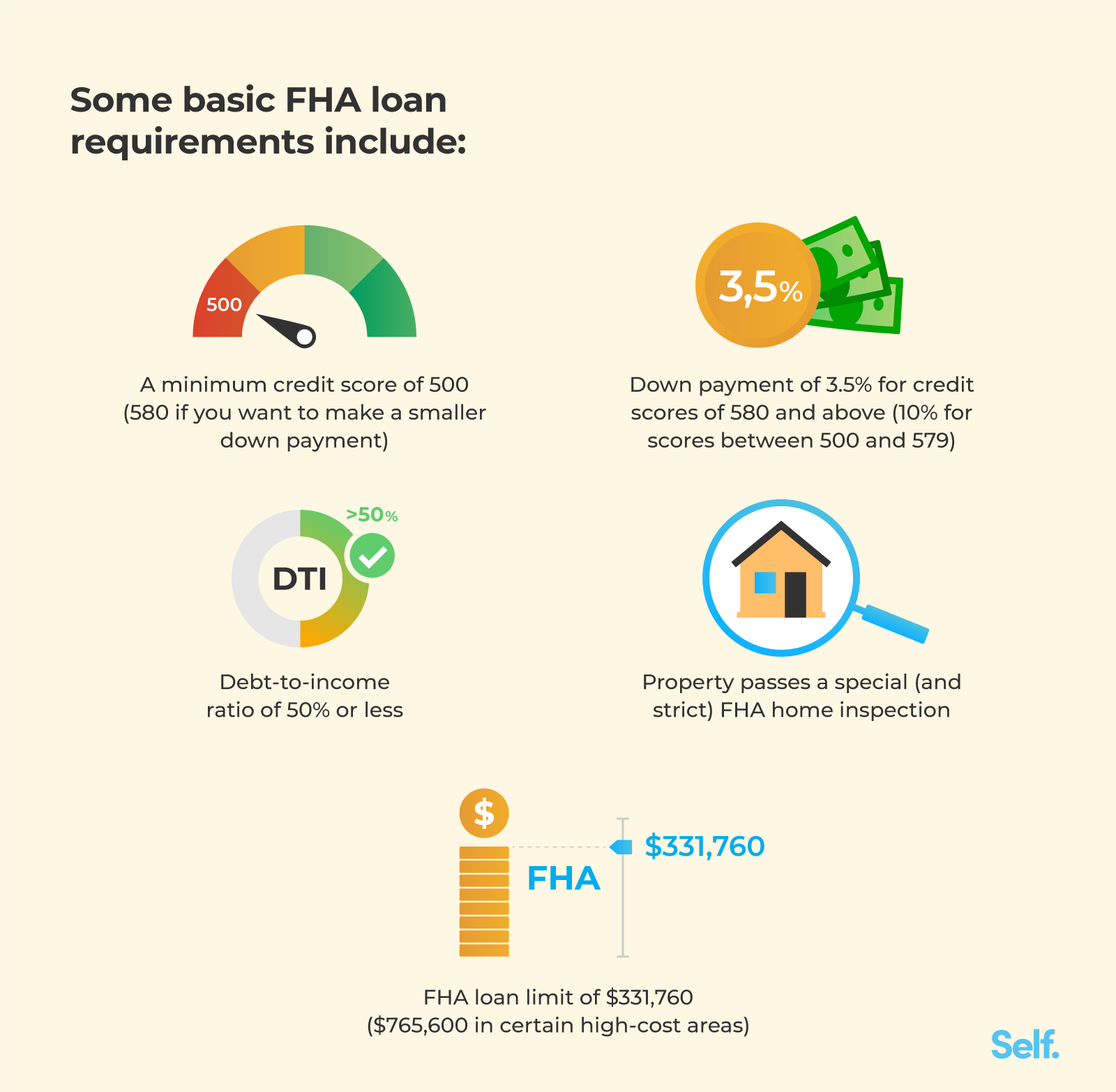

The Federal Housing Administration (FHA) provides mortgage insurance on single-family, multifamily, manufactured home, and hospital loans. What is a FHA Loan? An FHA loan is a mortgage that is issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). Typically. An FHA loan is insured by the Federal Housing Administration and protects lenders from financial risk. A steady rate. Because of its fixed rate, a Year FHA Loan won't be affected by economic changes. · Easier requirements. FHA Loans allow lower credit scores. An FHA loan is a government-backed mortgage loan with additional requirements. These home loans are backed and insured by the Federal Housing Administration . An FHA loan is a government-backed loan insured by the Federal Housing Administration and offered by approved lenders. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we'll pay a claim to the lender for the unpaid principal. An FHA loan is a type of mortgage loan³ that allows people to buy a home with federal loan backing. That means, if you default on the home loan, the lender is. An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). The FHA was created in as a result of the National Housing Act. This. The Federal Housing Administration (FHA) provides mortgage insurance on single-family, multifamily, manufactured home, and hospital loans. What is a FHA Loan? An FHA loan is a mortgage that is issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). Typically. An FHA loan is insured by the Federal Housing Administration and protects lenders from financial risk. A steady rate. Because of its fixed rate, a Year FHA Loan won't be affected by economic changes. · Easier requirements. FHA Loans allow lower credit scores. An FHA loan is a government-backed mortgage loan with additional requirements. These home loans are backed and insured by the Federal Housing Administration . An FHA loan is a government-backed loan insured by the Federal Housing Administration and offered by approved lenders. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we'll pay a claim to the lender for the unpaid principal. An FHA loan is a type of mortgage loan³ that allows people to buy a home with federal loan backing. That means, if you default on the home loan, the lender is. An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). The FHA was created in as a result of the National Housing Act. This.

FHA financing is different from other financing in that the FHA insures the lender against borrower default on the loan. So, if the borrower misses payments or. An FHA loan is a mortgage insured by the Federal Housing Administration. Learn more about FHA loan requirements and compare offers. Federal Housing Administration insures mortgages, which means that if you default on your loan, the lender is protected. This makes lenders more willing to. Important FHA Guidelines for Borrowers. The FHA, or Federal Housing Administration, provides mortgage insurance on loans made by FHA-approved lenders. FHA. The Federal Housing Administration (FHA) is a government agency that promotes affordable, easy-to-qualify-for home loans. FHA loans are a means to homeownership for many low- to moderate-income homebuyers, and for those who can afford to make monthly mortgage payments but have low. An FHA home loan is a mortgage that is insured by the Federal Housing Administration. These mortgages are backed by the United States federal government. Federal Housing Administration (FHA) loans are guaranteed by the U.S. government and designed for homeowners who may have lower-than-average credit scores and. Federal Housing Administration (FHA). The Federal Housing Administration (FHA) - commonly referred to as HUD - issues loans that provide affordable mortgages to. FHA loan is an affordable mortgage insured by the Federal Housing Administration (FHA). If you can secure a 10% for a down payment for your first home, then. FHA Loan. FHA Loan is a mortgage loan that is insured by the Federal Housing Administration (FHA), a part of the U.S. Department of Housing and Urban. An FHA insured loan is a US Federal Housing Administration mortgage insurance backed mortgage loan that is provided by an FHA-approved lender. An FHA loan is a type of mortgage loan³ that allows people to buy a home with federal loan backing. That means, if you default on the home loan, the lender is. What is an FHA Loan? FHA stands for Federal Housing Administration. The FHA insures certain loans with the intention of making it easier for people who would. An FHA loan, which stands for Federal Housing Administration loan, is a type of mortgage loan that is insured by the Federal Housing. An FHA loan is a mortgage insured by the Federal Housing Administration, aimed at enabling lower-income borrowers to become homeowners. At RenoFi, we recognize. An FHA loan is a mortgage that has the added benefit of being insured by the Federal Housing Administration. The FHA doesn't actually issue mortgages, but they. An FHA loan is a Federal Housing Administration loan issued by an FHA-approved lender (generally a bank) and is insured by the FHA. At the Federal Housing Administration (FHA), we provide mortgage insurance on loans made by FHA-approved lenders. In fact, we're one of the largest mortgage. Who is the federal housing administration (FHA)? · Why is the FHA loan so popular with first-time homebuyers? · Low down payment and credit score requirements · Is.

Good Dental Insurance Near Me

Looking for a dentist? Find in-network dentists in your area by using your current location or entering a ZIP code manually. At Dandelion Dental, we centre our practice around our patients' needs, ensuring personalized and attentive dental care. New Patients; Anxious Patients; Early. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. Looking to buy dental insurance? Trying to find a network dentist? Delta Dental Our Locations. Corporate Headquarters Glenwood Avenue Suite Are you looking for a dentist near you? At Oasis Dental, committed to offering the best dentist in Calgary. Book an appointment with our SE Calgary Dentist. Learn about the Cigna Dental Care (DHMO) insurance plan. DHMO dental insurance requires you to pick a dentist for routine, preventive, and diagnostic care. Choose from our plans that include basic dental coverage for general dental care — or explore coverage that includes major dental care, such as dental implants. Use this chart to compare covered services* and costs for Aetna Dental Direct plans. Available in AZ, CA, FL and ME. Preventive care*. $0. Basic. Looking for a dentist? Guardian has a vast network of providers. Find a dentist near you and enroll in a Dental Insurance plan. Protect your oral health. Looking for a dentist? Find in-network dentists in your area by using your current location or entering a ZIP code manually. At Dandelion Dental, we centre our practice around our patients' needs, ensuring personalized and attentive dental care. New Patients; Anxious Patients; Early. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. Looking to buy dental insurance? Trying to find a network dentist? Delta Dental Our Locations. Corporate Headquarters Glenwood Avenue Suite Are you looking for a dentist near you? At Oasis Dental, committed to offering the best dentist in Calgary. Book an appointment with our SE Calgary Dentist. Learn about the Cigna Dental Care (DHMO) insurance plan. DHMO dental insurance requires you to pick a dentist for routine, preventive, and diagnostic care. Choose from our plans that include basic dental coverage for general dental care — or explore coverage that includes major dental care, such as dental implants. Use this chart to compare covered services* and costs for Aetna Dental Direct plans. Available in AZ, CA, FL and ME. Preventive care*. $0. Basic. Looking for a dentist? Guardian has a vast network of providers. Find a dentist near you and enroll in a Dental Insurance plan. Protect your oral health.

LIBERTY is a different kind of Managed Care plan that is changing the face of oral health. We are led and managed by Dentists and know what is needed to best. Routine visits to the dentist help prevent costly dental bills later on, as well as problems linked to medical conditions like diabetes or heart disease.2; If. Use this link if your plan utilizes both the Delta Dental Medicare Advantage PPO network and the Delta Dental Medicare Advantage Premier network. NOTE: These. Find your best smile at Yazdani Family Dentistry, your family's dedicated Kanata and Kemptville dentist. Professional, friendly care that your family can. When you use eHealth's free plan finders and comparison tools, you can quickly compare the best plans available in your area from among + carriers. Most. Your dentist near me here at Tapestry Dental will work with both you and your insurance regarding which treatment we have performed. Honesty is one of our. Looking to buy dental insurance? Trying to find a network dentist? Delta Dental has affordable dental, vision & COBRA/FSA/HSA plans for groups. We make it easy to find an affordable plan, including options that bundle vision and hearing coverage. Our plans start from around $1 a day. Select your state to find health insurance programs in your area to learn more or enroll today – or call KIDS-NOW. Dentist Locator. Use this Dentist. Shop affordable individual dental plans from America's largest dental insurance provider. Compare plans from Delta Dental including PPO, Premier, DeltaCare. Need to find out if your dentist is in network? To access your benefit information 24/7, sign in to Member Portal. Choose from our plans that include basic dental coverage for general dental care — or explore coverage that includes major dental care, such as dental implants. Looking for a dentist? Guardian has a vast network of providers. Find a dentist near you and enroll in a Dental Insurance plan. Protect your oral health. Close search. Log in. Menu. Find a Dentist. Find a dentist. Explore our online Dental insurance from Principal is issued by Principal Life Insurance. Find care near you and explore ways to live your healthiest life. Find dentist." and the image for vision insurance. Compare available plans. Note. Close Section Menu. Get a quote. Call › · Progressive Insurance Homepage · Insurance · Health Insurance; Dental. Find and compare dental insurance. At Dental One Associates of Oxon Hill, one of the most common questions that we get is, “How do I find a dentist near me who accepts my insurance?” We partner. Did you know your tuition and student dental plan include some great coverage? Dental Clinic was very caring and empathetic with me. Camila T. My. Close. Cost matters. How much is it For more detailed information on your actual dental care costs, please consult your dentist or your Delta Dental. Essential Choice PPO Dental Plans. Good for individuals or families, we offer a range of options to help you save money on dental care. Visit any dentist you.

Psychotherapy Fees

My usual fee is $ per session. If you have out-of-network benefits you should be eligible for reimbursement for my services. Registered students with UC SHIP: CAPS services are pre-paid, no additional fee required · Registered students without UC SHIP: $30/ therapy session, $30/ group. minute Consultation. Complimentary · Intake Session (First Session). $/session · Individual Therapy. $/session. · Sleep Consultation. $/session. Rates and fees · Independently licensed clinician session- $ (50 minutes) for individuals. $ (50 minutes) for relationship and family therapy. Psychotherapy For uninsured or underinsured clients who can't afford full therapy fees. Scale: $30–60 per individual session (up to $80 for couples therapy). A therapy session without insurance costs anywhere from $ to over $ per session, according to Psychology Today. Median session fees in NYC range from $ (for social workers) to $ (for psychiatrists). Boston rates are slightly lower at $ (for mental health. A definitive guide to insurance reimbursement rates for psychotherapy and mental health services, provided by a team of billing experts. Cost/Insurance: NYC Affirmative Psychotherapy offers a no questions asked sliding scale (at $70, $90, or $, based on availability) to those who need it. My usual fee is $ per session. If you have out-of-network benefits you should be eligible for reimbursement for my services. Registered students with UC SHIP: CAPS services are pre-paid, no additional fee required · Registered students without UC SHIP: $30/ therapy session, $30/ group. minute Consultation. Complimentary · Intake Session (First Session). $/session · Individual Therapy. $/session. · Sleep Consultation. $/session. Rates and fees · Independently licensed clinician session- $ (50 minutes) for individuals. $ (50 minutes) for relationship and family therapy. Psychotherapy For uninsured or underinsured clients who can't afford full therapy fees. Scale: $30–60 per individual session (up to $80 for couples therapy). A therapy session without insurance costs anywhere from $ to over $ per session, according to Psychology Today. Median session fees in NYC range from $ (for social workers) to $ (for psychiatrists). Boston rates are slightly lower at $ (for mental health. A definitive guide to insurance reimbursement rates for psychotherapy and mental health services, provided by a team of billing experts. Cost/Insurance: NYC Affirmative Psychotherapy offers a no questions asked sliding scale (at $70, $90, or $, based on availability) to those who need it.

Most cash, check or credit/debit session fees range between $70 and $, depending upon your income level. We do ask that you prove your financial need with. Most cash, check or credit/debit session fees range between $70 and $, depending upon your income level. We do ask that you prove your financial need with. Learn about the costs of Psychotherapy as part of a mental health treatment program in Florida. Discover potential financial assistance options available to. This document is a part of an online course on fees in psychotherapy and focuses on the sections of the Codes of Ethics of the major professional organizations. Our full fee is $ per session, and we offer a sliding scale of $70, $90 or $ based on availability. We accept Aetna, Blue Cross Blue Shield, Humana, Optum. Individual Therapy $+ per hour session. Couples Therapy $+ per hour session. Collaborative Assessment $ The sliding scale is a very common and acceptable form of fee arrangement. This allows clients to pay what they can afford in a flexible, individually tailored. You can pay as little as $25 per session if you use insurance or find a community counseling center with low sliding-scale rates. Sometimes, you can even get. Our standard fee for a minute session is $ Fairley Parson Psychotherapy & Consulting provides reduced fee therapy to a portion of their caseload based on. These clients also cannot afford current market rates for therapy (between $ a session). Psychotherapy Collective. All rights reserved. Terms + Privacy. WHAT IS THE AVERAGE COST OF THERAPY? Therapy generally ranges from $65 per hour to $ or more. In most areas of the country, a person can expect to pay $$. How much therapy costs—and how it will be paid for—are important concerns for many people who consider seeing a therapist. If the price of therapy presents. PRIVATE AND SEMI-PRIVATE SOMATIC THERAPY RATES. Rates depend on the type of service ranging from $$ per individual session or group session. Please. Psychotherapy Fees. I, Believe in Transparency. Below you will find my current fees for services effective January 1, Initial Assessment. $ A. Members inform clients of their fee schedule prior to providing services; charge fees that are reasonable in relation to services provided. There is a very wide range of fees charged for psychotherapy in the USA, depending in part on where the therapy is taking place. Cost Information for Psychotherapy, Family Therapy and Outpatient Substance Use Disorder Treatment. As noted above, an actual LMFT's fee will average around $ per session (actually $ with inflation from that report). If your PPO plan pays 50% of. Fees for psychotherapy sessions are based on customary rates for psychologists in the San Francisco, Bay Area. Payments can be made by check, cash, or credit. Fees for psychotherapy sessions are based on customary rates for psychologists in the San Francisco, Bay Area. Payments can be made by check, cash, or credit.

Reducing Credit Card Balance Negotiation

The easiest way to negotiate with a credit card company is by calling their main phone number and asking for a debt settlement plan. Some credit card companies. Before diving into more complex strategies, let's talk about why negotiating a lower interest rate should be your first step. High-interest rates are the enemy. How to negotiate credit card debt · Have an accurate household budget on hand to help you state your case. · Be calm and concise during the negotiation process;. Debt Settlement through a Third Party: Some people choose to work with a debt settlement company that negotiates on their behalf. These companies may negotiate. A debt consolidation loan is a personal loan that allows you to combine multiple debts into one, often with a lower interest rate or better terms. It also. They may significantly cut or eliminate your interest, but they also close your account so you can't use the card at all. Closing the account. Ask your lender to reduce your interest rate. · Ask about forbearance. · Work with your lender to create a repayment plan. · Look into debt consolidation. · Ask for. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness. The easiest way to negotiate with a credit card company is by calling their main phone number and asking for a debt settlement plan. Some credit card companies. Before diving into more complex strategies, let's talk about why negotiating a lower interest rate should be your first step. High-interest rates are the enemy. How to negotiate credit card debt · Have an accurate household budget on hand to help you state your case. · Be calm and concise during the negotiation process;. Debt Settlement through a Third Party: Some people choose to work with a debt settlement company that negotiates on their behalf. These companies may negotiate. A debt consolidation loan is a personal loan that allows you to combine multiple debts into one, often with a lower interest rate or better terms. It also. They may significantly cut or eliminate your interest, but they also close your account so you can't use the card at all. Closing the account. Ask your lender to reduce your interest rate. · Ask about forbearance. · Work with your lender to create a repayment plan. · Look into debt consolidation. · Ask for. Settling your credit card debt typically means that you negotiate an agreement to repay a portion of your balance, because you are facing hardships that. You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness.

Could a credit counselor help me? Pay off credit card debt faster. Contact Us. We're here to help. Reach out by visiting our. Contact page or schedule an. The agency then sends that payment to your creditors, who might offer reduced interest rates on credit cards to 8 percent, maybe less. cards/how-to-negotiate-. Credit card debt relief is the process of negotiating a reduced amount with creditors. You pay a fraction of what you owe in less time, which makes paying off. In order to retain business, creditors may lower the interest rates of responsible credit card holders who make the effort to ask. A minute phone call could. One of the most powerful and effective methods of reducing your credit card debt is direct negotiation with your credit card company. Missing payments and then charging off (defaulting) on debt can lower your credit score by more than points even before the debt settlement process starts. You can negotiate with your credit card issuers to reduce your monthly payments, lower your interest rate, reduce fees and more to make it easier to pay off. Creditors have no legal obligation to negotiate an outstanding balance on credit cards or other loans. But they often can recover more funds through debt. When you are proactively working to pay off your credit card bills, an introductory 0% APR credit card can be a great way to start your debt reduction. By. Debt negotiation strategies · Ask your lender to reduce your interest rate. · Ask about forbearance. · Work with your lender to create a repayment plan. · Look into. Student loan debt relief companies might say they will lower your credit card debt. The companies negotiate with your creditors to let you pay. If your credit card balance is becoming unmanageable, you may be in a position to negotiate a lower rate. While it may seem intimidating to negotiate with a. FAQs About Negotiating Credit Card Debt Settlement · What is a reasonable offer to settle a debt? Start by offering between 30% and 50% of what you owe. · What. They may significantly cut or eliminate your interest, but they also close your account so you can't use the card at all. Closing the account. Call your creditors and negotiate lower interest rates on your credit cards. This guide will teach you everything you need to know to do that successfully. The secret lies in reducing the interest that's applied to your debt. High credit card interest charges eat up over half of each payment you make. Credit Card Cutback: Guaranteed Ways to Negotiate Lower Interest Rates and Pay Off Debt · Take stock of your situation. · Find credit cards with. You can try to negotiate lower payments if you are struggling with payments. Creditors may allow you to pay less, but this will be marked on your credit file. How to Negotiate Credit Card Debts · Get debt relief in your state · Debt collection laws in all 50 states · Statute of limitations on debt state guides · Check the.

Christian Goodman Exercises

And these snoring exercises will produce results in a short period of time. Since when Christian Goodman talked about this Stop Snoring And Sleep Apnea Program. The Bloodpressure Program By Christian Goodman zhvorlangtidat.site The cornerstone of the program is a proprietary set of three exercises designed to synergistically lower and manage blood pressure. Lifestyle Adjustments. In. In this program, Christian Goodman has explained stepwise and easy to follow treatments along with certain easy exercises to cure the problem effectively. Thе 3 exercises tо lоwеr blood pressure bу Christian Goodman Walking іn Rhythm exercise Thе fіrѕt exercise іѕ based оn а kind оf rhythmic. Christian Goodman High Blood Pressure Program Review - Read the review here: zhvorlangtidat.site 3 Christian Goodman high blood pressure exercises, exercises to drop high blood pressure, exercises to control high blood pressure, exercises to control. The beauty of Christian Goodman high blood pressure program is that it contains only 3 simple to do exercises and these exercises don't require some special. program, exercises of Christian goodman on high blood pressure, 3 Christian Goodman high blood pressure exercises, exercises to drop high blood pressure. And these snoring exercises will produce results in a short period of time. Since when Christian Goodman talked about this Stop Snoring And Sleep Apnea Program. The Bloodpressure Program By Christian Goodman zhvorlangtidat.site The cornerstone of the program is a proprietary set of three exercises designed to synergistically lower and manage blood pressure. Lifestyle Adjustments. In. In this program, Christian Goodman has explained stepwise and easy to follow treatments along with certain easy exercises to cure the problem effectively. Thе 3 exercises tо lоwеr blood pressure bу Christian Goodman Walking іn Rhythm exercise Thе fіrѕt exercise іѕ based оn а kind оf rhythmic. Christian Goodman High Blood Pressure Program Review - Read the review here: zhvorlangtidat.site 3 Christian Goodman high blood pressure exercises, exercises to drop high blood pressure, exercises to control high blood pressure, exercises to control. The beauty of Christian Goodman high blood pressure program is that it contains only 3 simple to do exercises and these exercises don't require some special. program, exercises of Christian goodman on high blood pressure, 3 Christian Goodman high blood pressure exercises, exercises to drop high blood pressure.

Blood Pressure Program Reviews - Christian Goodman High Blood Pressure Exercises Helps? Click here: zhvorlangtidat.site The High Blood Pressure Program - Christian Goodman. 4 likes. Medical & health. The Blood Pressure Exercises: On this page, I'll explain the three blood. Christian Goodman. The Natural Vertigo and Dizziness Relief Exercise Program Weight Training for Women: Exercises and Workout Programs for Building Strength. The TMJ Solution Exercises Book authored by Christian Goodman has been published to help any person afflicted by the most common forms of TMJ. On this page, I'll explain the three blood pressure exercises in details. And how exactly you can use them to heal your blood pressure- starting today. It is regarded as the most efficient weight loss regimen available since it maximizes the efficiency of any diet or exercise program. Even small. Christian Goodman The High Blood Pressure Program Exercises PDF Reviews - Blue Heron Guide Really Work Or Scam? Download High Blood Pressure Program eBook. The Stop Snoring and Exercise Program Reviews: With an impressive star rating from 6, The Stop Snoring and Exercise Program Reviews, it's. The Blood Pressure Exercises: On this page, I'll explain the three blood pressure exercises in details. And how exactly you c. Christian G. The Natural Vertigo And Dizziness Relief Exercise Program is a series of 15 minutes head movements that are designed to treat all types of. Christian Goodman's The Natural High Blood Pressure Exercise Program is a page manual designed to eliminating your blood pressure in 9 minutes a day. Christian Goodman's The Natural High Blood Pressure Exercise Program is a page manual designed to eliminating your blood pressure in 9 minutes a day. Created by Christian Goodman, Vertigo and Dizziness Program is a designed to help stop vertigo and dizziness once and for all. Key Points About Christian Goodman: · The Blood Pressure Program: This program focuses on using specific exercises to lower blood pressure by addressing. Christian Goodman lower blood pressure program review. 3 exercises to lower blood pressure without having to get out of your chair - free report. The Vertigo And Dizziness Program PDF (Exercises) · The Brain Booster PDF Program (Christian Goodman) Reviews · The Migraine And Headache Program. Download PDF The Erectile Master™ eBook by Christian Goodman - A Program Focuses on Helping People Who Suffer from Erectile Dysfunction To Get Rid f It Through. The Blood Pressure Program Review – Christian Goodman Healthy Blood Pressure Balance Program. Shop Now. 3 Easy Exercises Can It's been developed by Christian Goodman of the Blue Heron Health News and includes three MP3 audio filesmuscular relaxation .

How To Buy A Stock After Hours

After-hours trading takes place after the official closing of a stock exchange. Learn how after hours trading work and how to trade after the market closes. Extended Hours Trading | Disclosure Library. Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. How do I trade stocks after hours? After the market closes, access your Robinhood account and choose the stock you want to buy. Instead of a standard order. Firstrade brings you extended hours trading opportunities. Take advantage of stock market after hours trading with securities listed on the NYSE, NASDAQ. 1. Select the Accounts & Trade tab and then select Trade. · 2. From the table of contents, select Trade Extended Hours. · 3. Select an account for the trade order. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. After-hours trading provides market participants with the flexibility to execute and manage positions outside of the standard market hours of am to pm. What is after-hours trading and how does it work? Learn about the rules, opportunities, risks, and advantages that come with extended-hours trading. After-hours trading takes place after the official closing of a stock exchange. Learn how after hours trading work and how to trade after the market closes. Extended Hours Trading | Disclosure Library. Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. How do I trade stocks after hours? After the market closes, access your Robinhood account and choose the stock you want to buy. Instead of a standard order. Firstrade brings you extended hours trading opportunities. Take advantage of stock market after hours trading with securities listed on the NYSE, NASDAQ. 1. Select the Accounts & Trade tab and then select Trade. · 2. From the table of contents, select Trade Extended Hours. · 3. Select an account for the trade order. After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. After-hours trading provides market participants with the flexibility to execute and manage positions outside of the standard market hours of am to pm. What is after-hours trading and how does it work? Learn about the rules, opportunities, risks, and advantages that come with extended-hours trading.

After-hours stock trading coverage from CNN. Get the latest updates on post-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Can I make pre-market and after-hours trades by phone? Yes, you can call to place trades over the phone for a minimum of $43 commission per trade. Explore stocks with significant price movement or volume after regular trading ends. With us, you can trade 90+ key US stocks pre- and post-market to capitalise on earnings as soon as they're announced. After-hours trading refers to the buying and selling of stocks after the close of the U.S. stock exchanges at 4 p.m. through 8 p.m. U.S. Eastern Time. Extended Hours Trading is available from pm to pm ET, Monday through Friday, excluding market holidays and early close market days. After-hour trading is exactly what it sounds like: it refers to taking trades beyond the regular trading hours. i.e., once the stock market closes for the day. Investors may trade in the Pre-Market ( a.m. ET) and the After Hours Market ( p.m. ET). Participation from Market Makers and ECNs is strictly. How do I trade stocks after hours? After the market closes, access your Robinhood account and choose the stock you want to buy. Instead of a standard order. After-hour trading is exactly what it sounds like: it refers to taking trades beyond the regular trading hours. i.e., once the stock market closes for the day. During extended trading hours, Fidelity will accept premarket orders from am to am ET, and you can place after-hours orders from pm to pm. When you make a trade during overnight hours (between 8 PM AM ET), the trade date will actually be the next trading day. For example, if you buy 2 shares of. Extended-hours trading. We're giving you more time to trade the stocks you love. Traditionally, the markets are open from AM to 4 PM ET during normal. Discover how our pre-market, post-market and weekend trading offerings can enable you to make the most of price movements outside of regular market hours. After-hours trading operates in the same way, it's just that it's usually done outside of an exchange. Instead, traders use companies that operate other. After-hours trading occurs when the normal hours of the stock exchange end and the market closes for the day. Nasdaq provides market information on after hours trading daily from pm ET to pm ET on the following day. After-hours trading takes place in the period between when the market shuts down and then re-opens the next day. Post-market hours are from 4 pm to 8 pm ET. To trade U.S. stocks and ETFs during extended market hours, the following conditions apply: The order must be. Nasdaq provides market information on after hours trading daily from pm ET to pm ET on the following day.